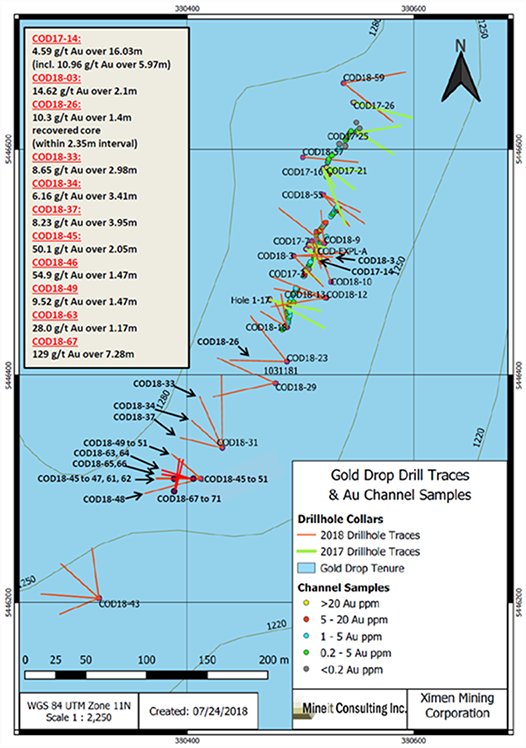

Vancouver, British Columbia – Mar 20, 2019 – GGX Gold Corp. (TSX-v: GGX), (OTCQB: GGXXF), (FRA: 3SR2) (the “Company” or “GGX”) is pleased to announce it has begun preparing for the spring 2019 diamond drilling program on the Gold Drop Property, located in Southern British Columbia. The program is scheduled to begin in early April. The spring drilling program will focus on the COD vein located in the Gold Drop Southwest Zone. The program will further test the southern extension of the COD vein. The Company intersected near-surface, high- grade gold, silver and tellurium in this part of the vein during 2018 diamond drilling.

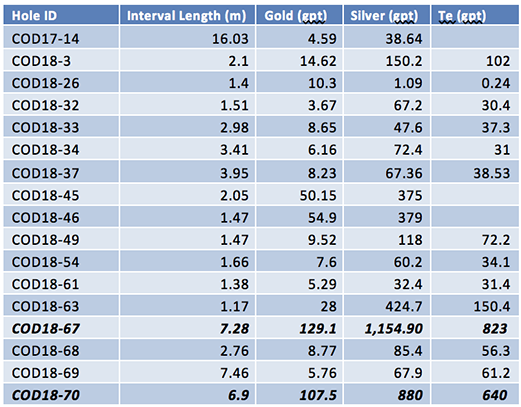

- COD18-67: 129 g/t gold, 1,154 g/t silver & 823 g/t tellurium over 7.28 meters core length.

- COD18-70: 107 g/t gold, 880 g/t silver & 640 g/t tellurium over 6.90 meters core length.

The highlights of the 2018 diamond drilling program are drill holes COD18-67 and COD18-70 that intersected near-surface, high-grade gold, silver and tellurium in the southern extension of the COD vein. COD18-67 intersected 129 grams per tonne (g/t) gold, 1154 g/t silver & 823 g/t tellurium over 7.28-meter core length while COD18-70 intersected 107 g/t gold, 880 g/t silver & 640 g/t tellurium over 6.90-meter core length (News Releases of January 11, January 18 and March 18, 2019). The COD vein system has been traced by trenching and diamond drilling for close to 400 meters along strike. The vein system is open along strike and at depth.

Intersections for 2017 and 2018 diamond drill holes at the C.O.D. vein include the following (please refer to the Company’s website for News Releases announcing these results):

Other targets in the Gold Drop Southwest Zone include the COD north region. No previous diamond drilling has been completed in this region. The 2018 trenching program exposed numerous vein showings with grab samples up to 15.45 g/t gold, 159 g/t silver Ag and 114.5 g/t tellurium. A chip sample (0.4 meters long) returned 21.7 g/t gold, 216 g/t silver and 149 g/t tellurium (News Release of February 27, 2019).

Data from the previous exploration programs is currently under review to identify other specific exploration targets.

The Company is also pleased to announce that it has arranged a non-brokered private placement of 4.2 million flow through units at a price of Cdn$0.12 per unit for gross proceeds of $504,000. Each Flow-Through Unit consists of one common share that qualifies as a “flow-through share” as defined in subsection 66(15) of the Income Tax Act and one [non-]transferable common share purchase warrant. Each whole warrant will entitle the holder to purchase, for a period of 18 months from the date of issue, one additional non-flow-through common share of the Issuer at an exercise price of Cdn$0.15 per share. The proceeds of the private placement will be used for continued exploration work including diamond drilling and trenching at the Company’s Gold Drop property near Greenwood in Southern British Columbia.

A finder’s fee may be paid to eligible finders in accordance to the TSX-V policies. All securities issued pursuant to the offering will be subject to a hold period of four months and one day from the date of closing. The offerings and payment of finders’ fees are both subject to approval by the TSX-V.

David Martin, P.Geo., a Qualified Person as defined by NI 43-101 and consultant for GGX Gold Corp., is responsible for the technical information contained in this News Release.

To view the Original News release with pictures please go to the website or contact the company.

On Behalf of the Board of Directors,

Barry Brown, Director

604-488-3900

Office@GGXGold.com

Investor Relations: Mr. Jack Singh, 604-488-3900 ir@GGXgold.com

“ We don’t have to do this, we get to do this ”

The Crew

Forward Looking Information

This news release includes certain statements that constitute “forward-looking information” within the meaning of applicable securities law, including without limitation, the Company’s information and statements regarding or inferring the future business, operations, financial performance, prospects, and other plans, intentions, expectations, estimates, and beliefs of the Company. Such statements include statements regarding the completion of the proposed transactions. Forward-looking statements address future events and conditions and are necessarily based upon a number of estimates and assumptions. These statements relate to analyses and other information that are based on forecasts of future results, estimates of amounts not yet determinable and assumptions of management. Any statements that express or involve discussions with respect to predictions, expectations, beliefs, plans, projections, objectives, assumptions or future events or performance (often, but not always, using words or phrases such as “expects” or “does not expect”, “is expected”, “anticipates” or “does not anticipate”, “plans”, “estimates” or “intends”, or stating that certain actions, events or results “may”, “could”, “would”, “might” or “will” be taken, occur or be achieved), and variations of such words, and similar expressions are not statements of historical fact and may be forward-looking statements. Forward-looking statement are necessarily based upon several factors that, if untrue, could cause the actual results, performances or achievements of the Company to be materially different from future results, performances or achievements express or implied by such statements. Such statements and information are based on numerous assumptions regarding present and future business strategies and the environment in which the Company will operate in the future, including the price of gold and other metals, anticipated costs and the ability to achieve goals, and the Company will be able to obtain required licenses and permits. While such estimates and assumptions are considered reasonable by the management of the Company, they are inherently subject to significant business, economic, competitive and regulatory uncertainties and risks including that resource exploration and development is a speculative business; that environmental laws and regulations may become more onerous; that the Company may not be able to raise additional funds when necessary; fluctuating prices of metals; the possibility that future exploration, development or mining results will not be consistent with the Company’s expectations; operating hazards and risks; and competition. There can be no assurance that economic resources will be discovered or developed at the Gold Drop Property. Accordingly, actual results may differ materially from those currently anticipated in such statements. Factors that could cause actual results to differ materially from those in forward looking statements include continued availability of capital and financing and general economic, market or business conditions, the loss of key directors, employees, advisors or consultants, equipment failures, litigation, competition, fees charged by service providers and failure of counterparties to perform their contractual obligations. Investors are cautioned that forward-looking statements are not guarantees of future performance or events and, accordingly are cautioned not to put undue reliance on forward-looking statements due to the inherent uncertainty of such statements. The forward-looking statements included in this news release are made as of the date hereof and the Company disclaims any intention or obligation to update or revise any forward-looking statements, whether as a result of new information, future events or otherwise, except as expressly required by applicable securities legislation.

Neither TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in the policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this release.

This press release shall not constitute an offer to sell or the solicitation of an offer to buy any securities, nor shall there be any sale of securities in any state in the United States in which such offer, solicitation or sale would be unlawful. The securities referred to herein have not been and will not be registered under the United States Securities Act of 1933, as amended, and may not be offered or sold in the United States absent registration or an applicable exemption from registration requirements.