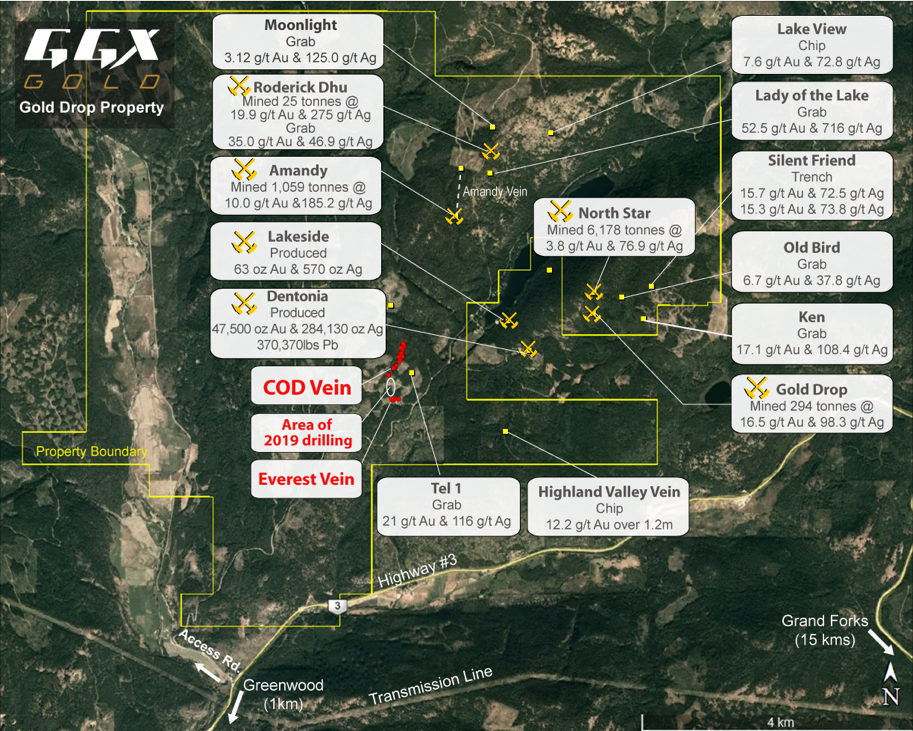

Vancouver, British Columbia – August 30, 2019 – GGX Gold Corp. (TSX-v: GGX), (OTCQB: GGXXF), (FRA: 3SR2) (the “Company” or “GGX”) is pleased to announce that is has completed all payments of shares and cash to earn a 100% interest in it’s Gold Drop Property located about nine kilometers northeast from Greenwood, British Columbia, in the Greenwood Gold Mining district. The final payment to Ximen Mining Corp. consisted of 600,000 common shares with a value of $150,000 and a $100,000 cash payment. This share and cash payment as well as meeting the required exploration expenditures has completed the Company’s obligations to earn a 100% interest.

Barry Brown, CEO comments, “We are extremely excited to have completed the option payments and expenditures to acquire a 100% interest in the Gold Drop Property. It is an important milestone for GGX Gold as exploration work to date has significantly advanced the potential of the project. We look forward to aggressively continuing our exploration program.”

Ximen will retain a 2.5% net smelter return royalty (the “NSR Royalty”) which the Company may buy down 1% of the NSR Royalty by paying $1,000,000. Upon completion of the option requirements by the Company, Ximen will have a right for nine months thereafter to elect to form a joint venture by paying the Company an amount of money equal to 30% of the total amount expended on the property by the Company. If Ximen exercises this joint-venture right, the Company and Ximen will enter into a joint venture for the exploration and development of the property.

The Company also closed the final tranches of the private placement announced on June 18, 2019 and July 24, 2019 for gross proceeds of $103,500. Each flow-through unit will comprise one common share (which is a flow-through share for Canadian income tax purposes) and one-half share purchase warrant. Each whole flow-through warrant will entitle the holder to purchase one additional common share which is not a flow-through share at the price of 35 cents for 18 months after closing. The term of the warrants may be accelerated in the event that the issuer’s shares trade at or above a price of 40 cents per share for a period of 10 consecutive days. In such case of accelerated warrants, the issuer may give notice, in writing or by way of news release, to the subscribers that the warrants will expire 20 days from the date of providing such notice. The flow-through tranche totaled $42,500 and the hold expiry date for this final tranche consisting of 170,000 units is December 29, 2019. Each non-flow-through unit will comprise one common share and one share purchase warrant. Each non-flow-through warrant will entitle the holder to purchase one additional common share at the price of 30 cents for a period of 18 months after closing. The term of the warrants may be accelerated in the event that the issuer’s shares trade at or above a price of 40 cents per share for a period of 10 consecutive days. In such case of accelerated warrants, the issuer may give notice, in writing or by way of news release, to the subscribers that the warrants will expire 20 days from the date of providing such notice. The non flow-through tranche totaled $61,000 and the hold expiry date for this final tranche consisting of 305,000 units is December 29, 2019.

Proceeds from the private placement will be used for the continued exploration work on the Gold Drop property, potential project acquisitions, property option payments as well as general working capital.

The Company paid a cash commission of $1,400.00 to PI Financial Corp. and $3,080.00 to Mackie Research Capital Corporation.

The Company also issued 5,600 broker warrants to PI Financial Corp. and 15,400 broker warrants to Mackie Research Capital Corporation. The broker warrants have the same terms as the private placement warrants.

The Company has granted one million stock options at an exercise price of 22 cents to its directors, officers, employees and consultants. The options are exercisable for five years and will be cancelled 30 days after cessation of acting as director, officer, employee or consultant of the Company. The stock options are not transferable and will be subject to a four-month hold period from the date of grant and any applicable regulatory acceptance.

On Behalf of the Board of Directors

Barry Brown, Director

604-488-3900

Office@GGXgold.com

Investor Relations:

Mr. Jack Singh,

604-488-3900,

IR@GGXgold.com

Forward Looking Statement

This News Release may contain forward-looking statements including but not limited to comments regarding the acquisition of certain mineral claims. Forward-looking statements address future events and conditions and therefore involve inherent risks and uncertainties. Actual results may differ materially from those currently anticipated in such statements and Revolver undertakes no obligation to update such statements, except as required by law.

Forward-looking statements are based on the then-current expectations, beliefs, assumptions, estimates and forecasts about the business and the industry and markets in which the Company operates, including that: the current price of and demand for minerals being targeted by the Company will be sustained or will improve; the Company will be able to obtain required exploration licences and other permits; general business and economic conditions will not change in a material adverse manner; financing will be available if and when needed on reasonable terms; the Company will not experience any material accident; and the Company will be able to identify and acquire additional mineral interests on reasonable terms or at all. Forward-looking statements are not guarantees of future performance and involve risks, uncertainties and assumptions which are difficult to predict. Investors are cautioned that all forward-looking statements involve risks and uncertainties, including: that resource exploration and development is a speculative business; that environmental laws and regulations may become more onerous; that the Company may not be able to raise additional funds when necessary; fluctuations in currency exchange rates; fluctuating prices of commodities; operating hazards and risks; competition; potential inability to find suitable acquisition opportunities and/or complete the same; and other risks and uncertainties listed in the Company’s public filings. These risks, as well as others, could cause actual results and events to vary significantly. Accordingly, readers should not place undue reliance on forward-looking statements and information, which are qualified in their entirety by this cautionary statement. There can be no assurance that forward-looking information, or the material factors or assumptions used to develop such forward looking information, will prove to be accurate. The Company does not undertake any obligations to release publicly any revisions for updating any voluntary forward-looking statements, except as required by applicable securities law.

Neither TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in the policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this release